– ux/ui designer

Nedbank Digital Customer Journey

PROBLEM STATEMENT

Many Nedbank customers struggle to access the banking app and need intensive assistance to verify themselves on the app or when creating an account. There is no one particular, consistent way to verify, activate a digital profiles, and begin banking on the app or online. This causes customers extreme frustration and they have to take time to visit the nearest branch to resolve.

Experience Design Strategy

My task was to understand the gaps in service and the actual journey a customer follows when they need to activate or access their digital profile whether online, the app or in the branch. The deliverable would be a series of reports sharing the frustrations of customers and banking staff, the gaps in the product journey and create journeys to help formulate a consistent solution.

TEAM

• CX Design Lead (me)

• Design Lead

• Product Owner

• Stakeholders: Product Design Head, Digital Executives, Bank Branch Managers

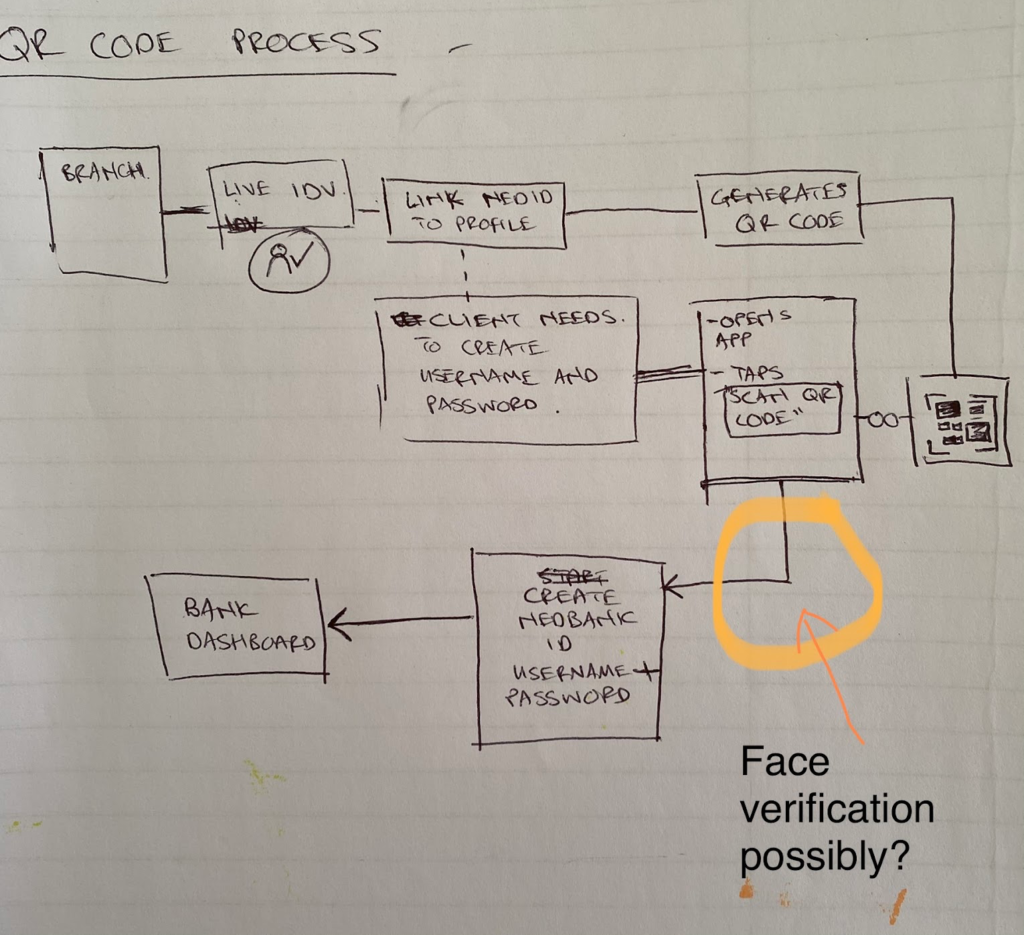

JOURNEY MAPPING AND USER FLOWS

I needed to understand what journey a typical Nedbank client followed when wanting to contact the bank with any query, specifically within the live chat space.

The following is evidence of the journeys and research and only portions of the reports can be shared due to intellectual property and confidentiality.

Ongoing Project

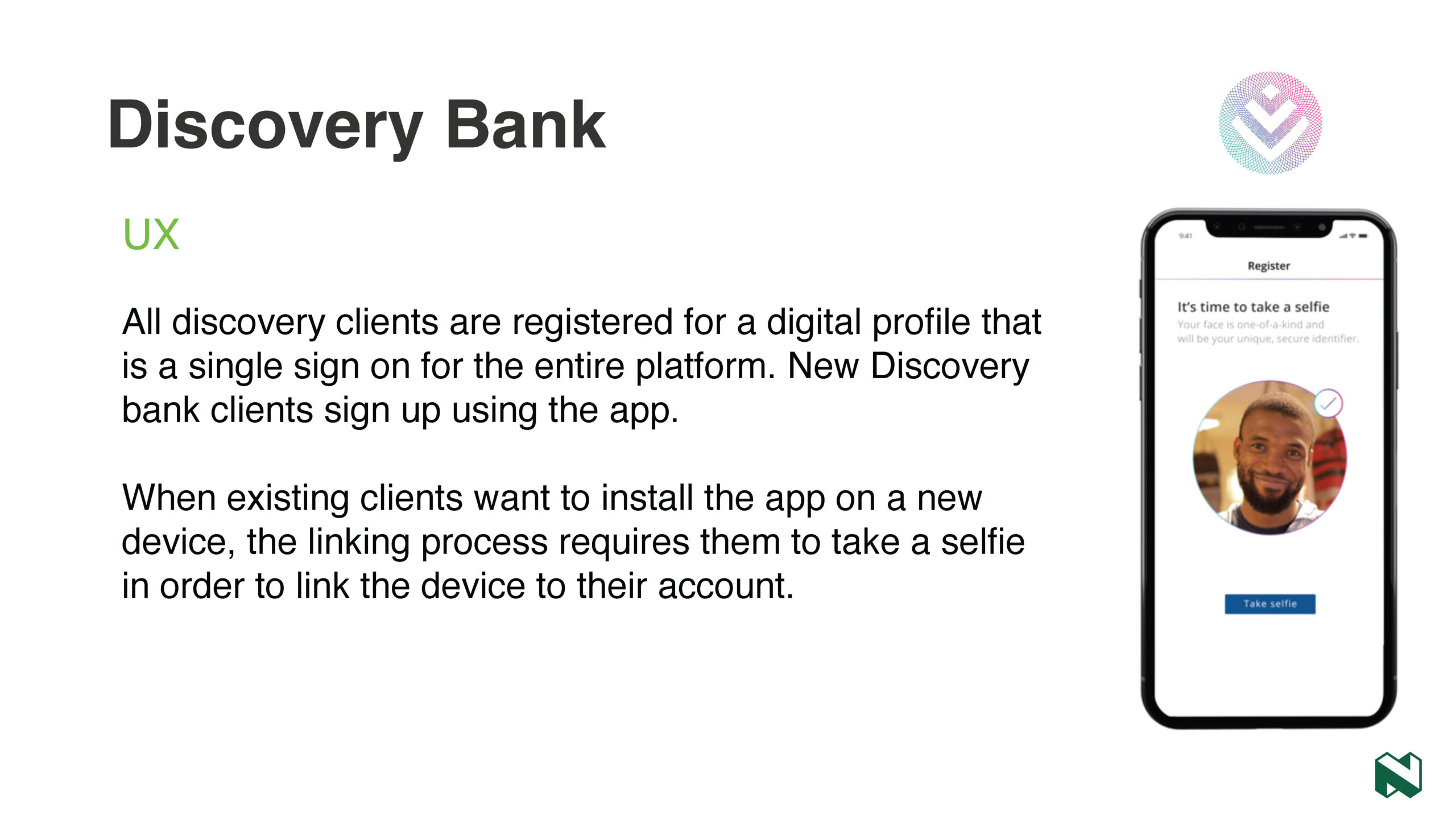

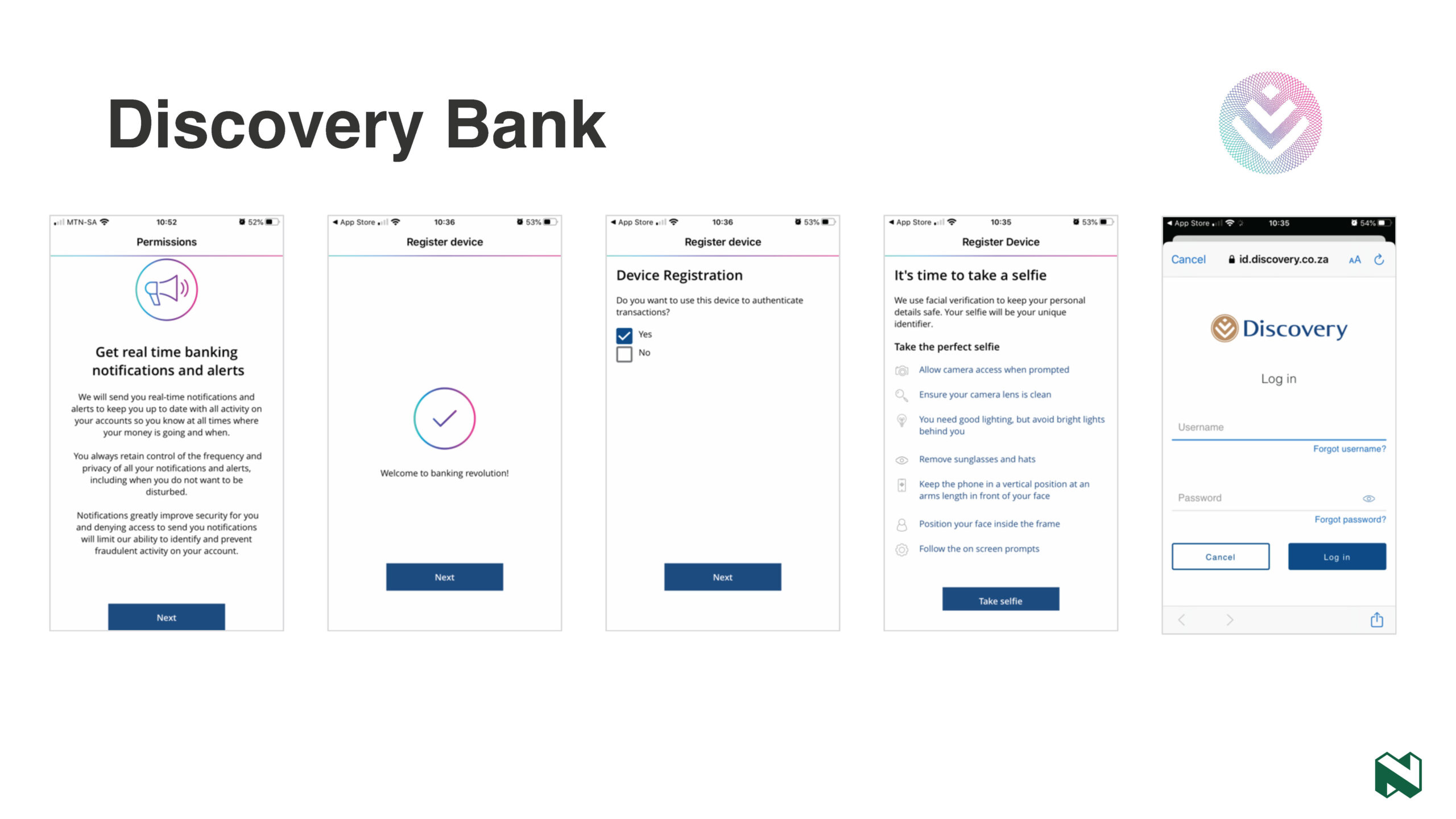

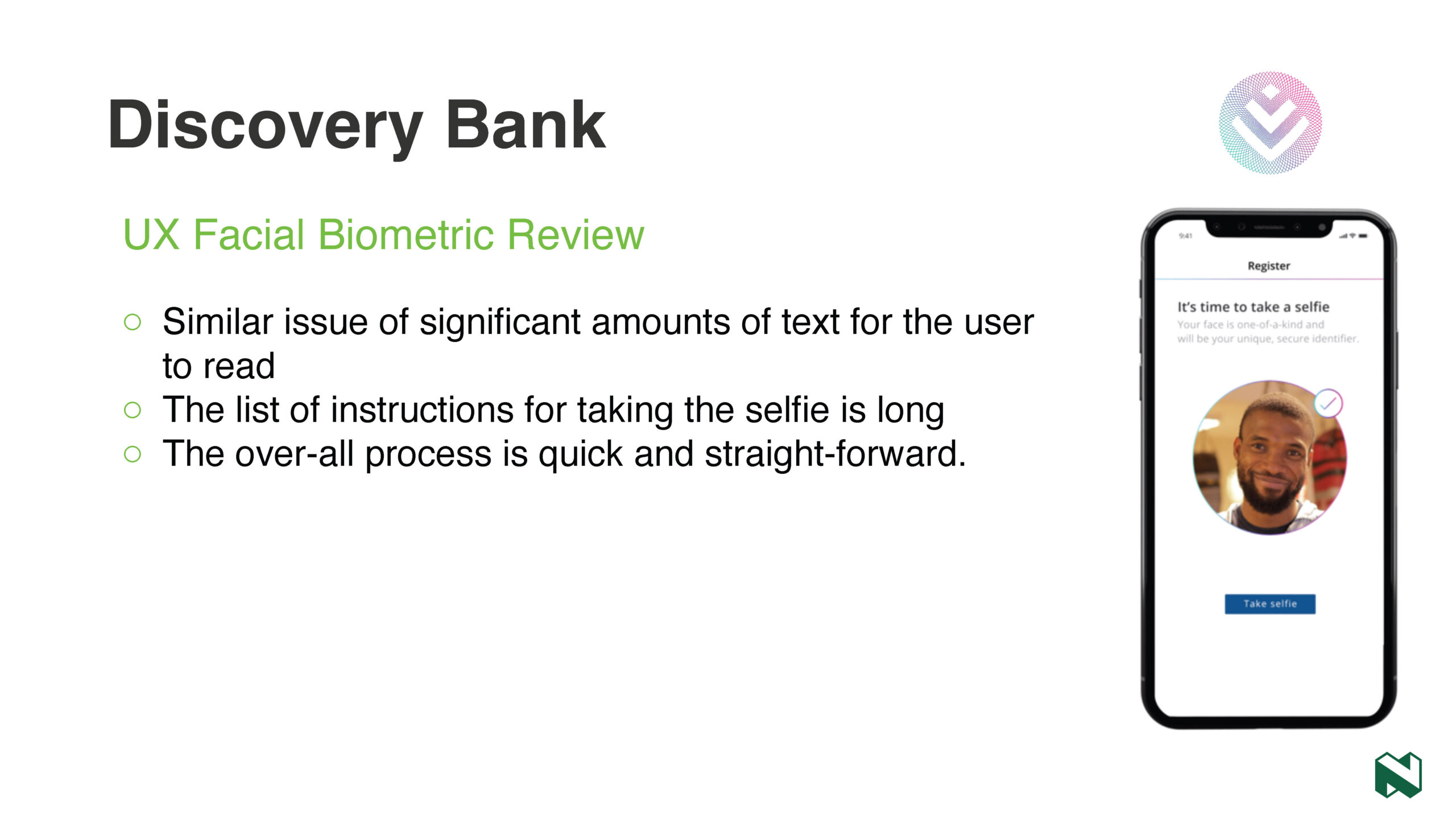

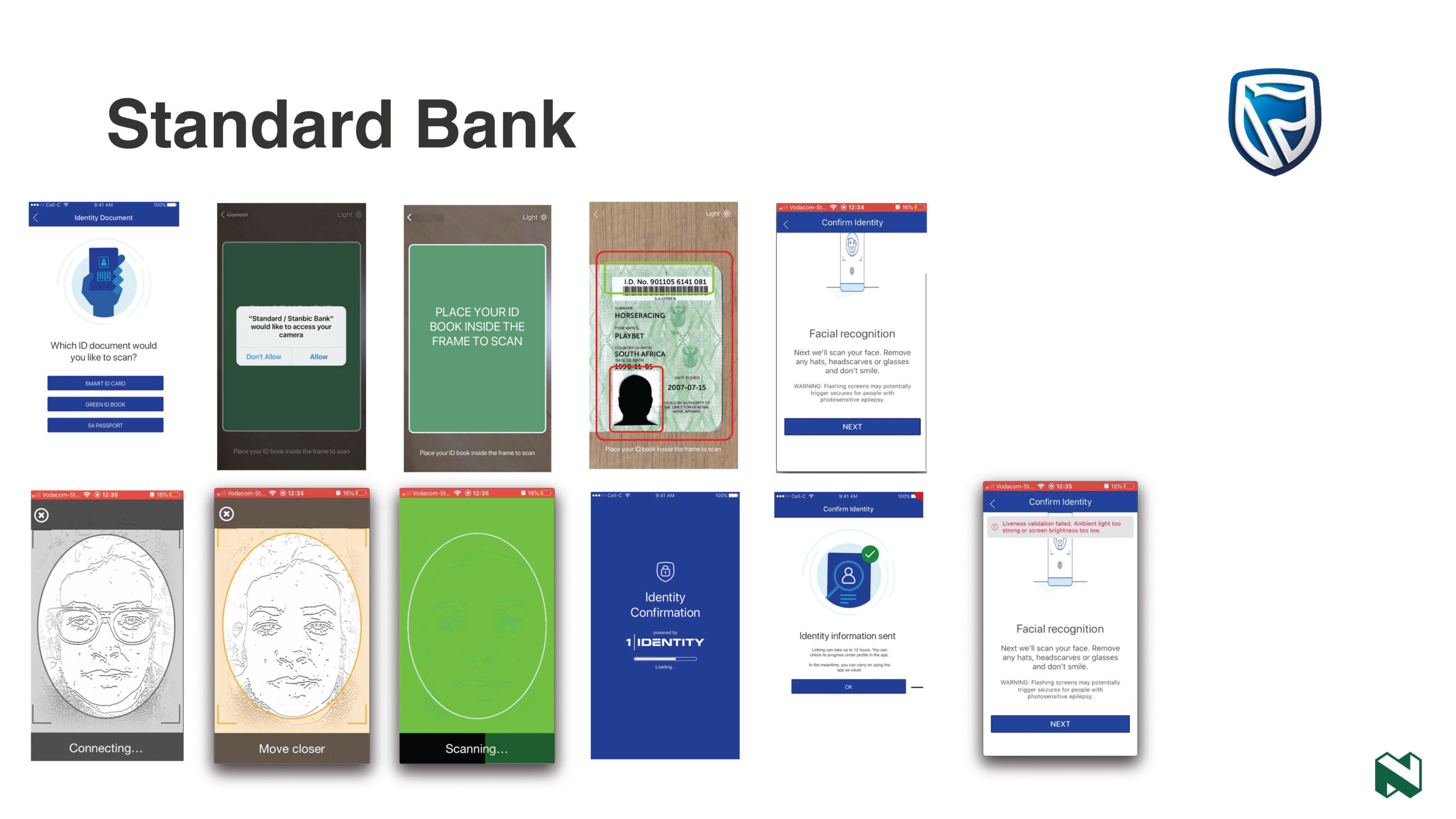

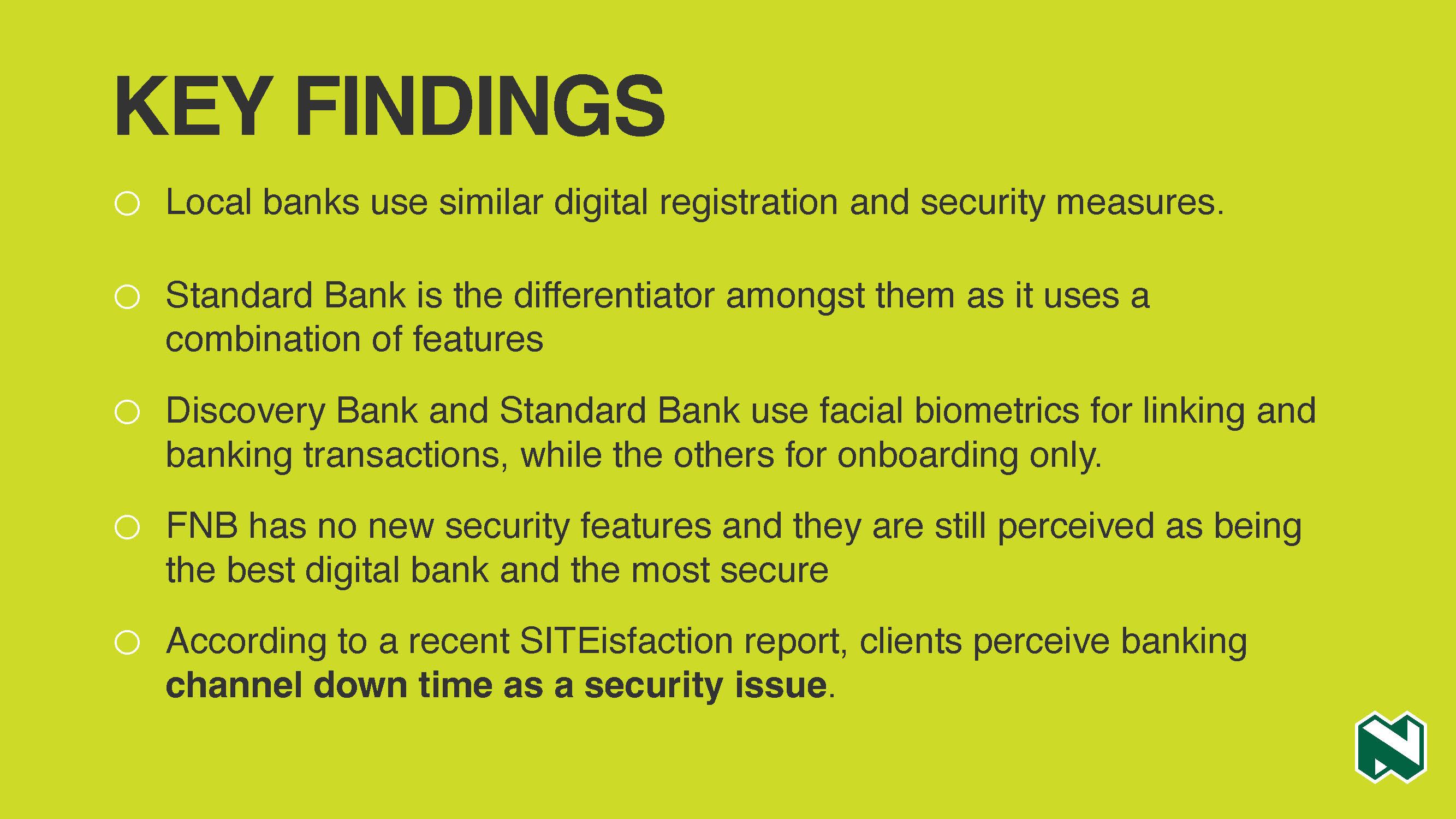

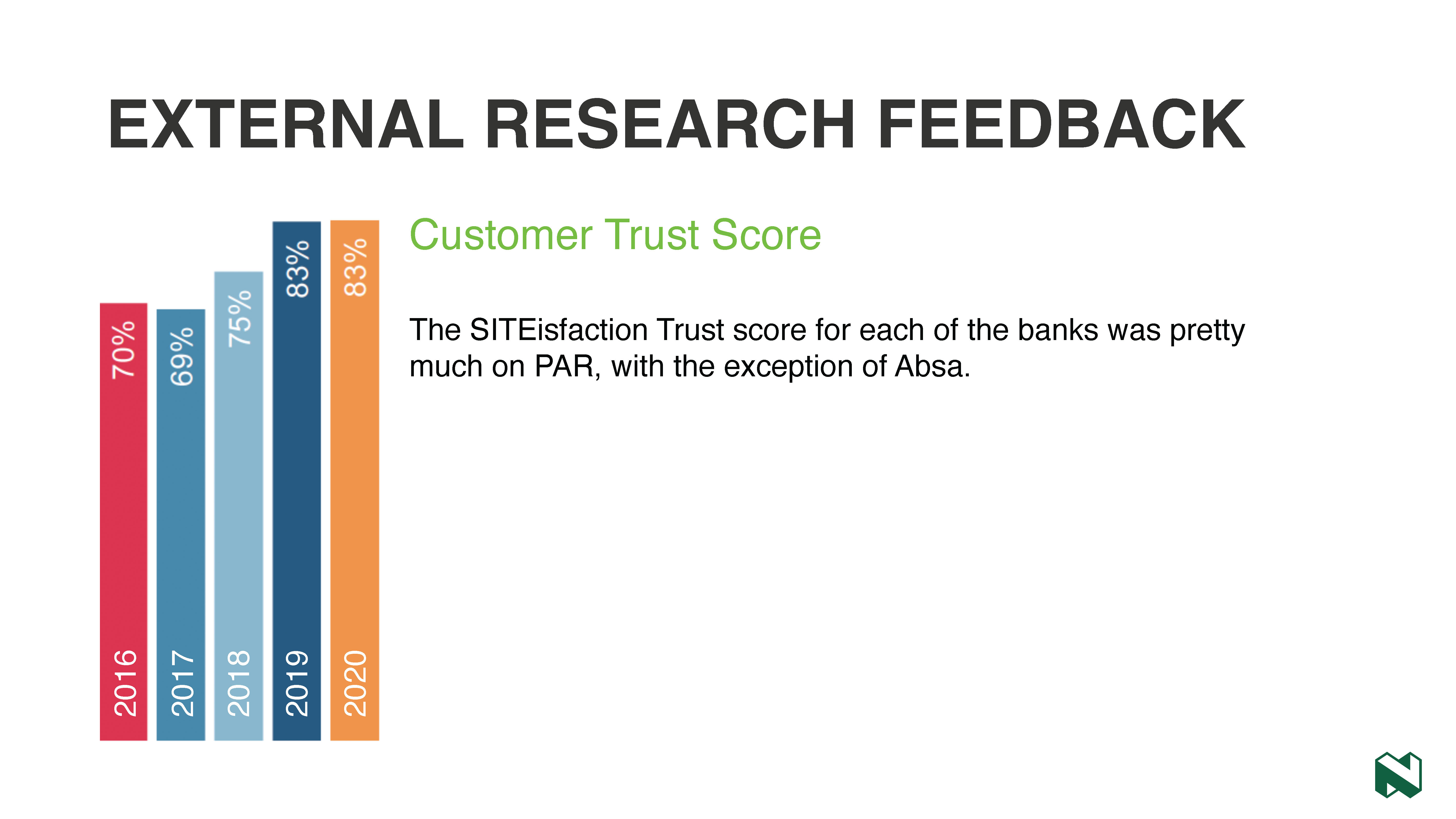

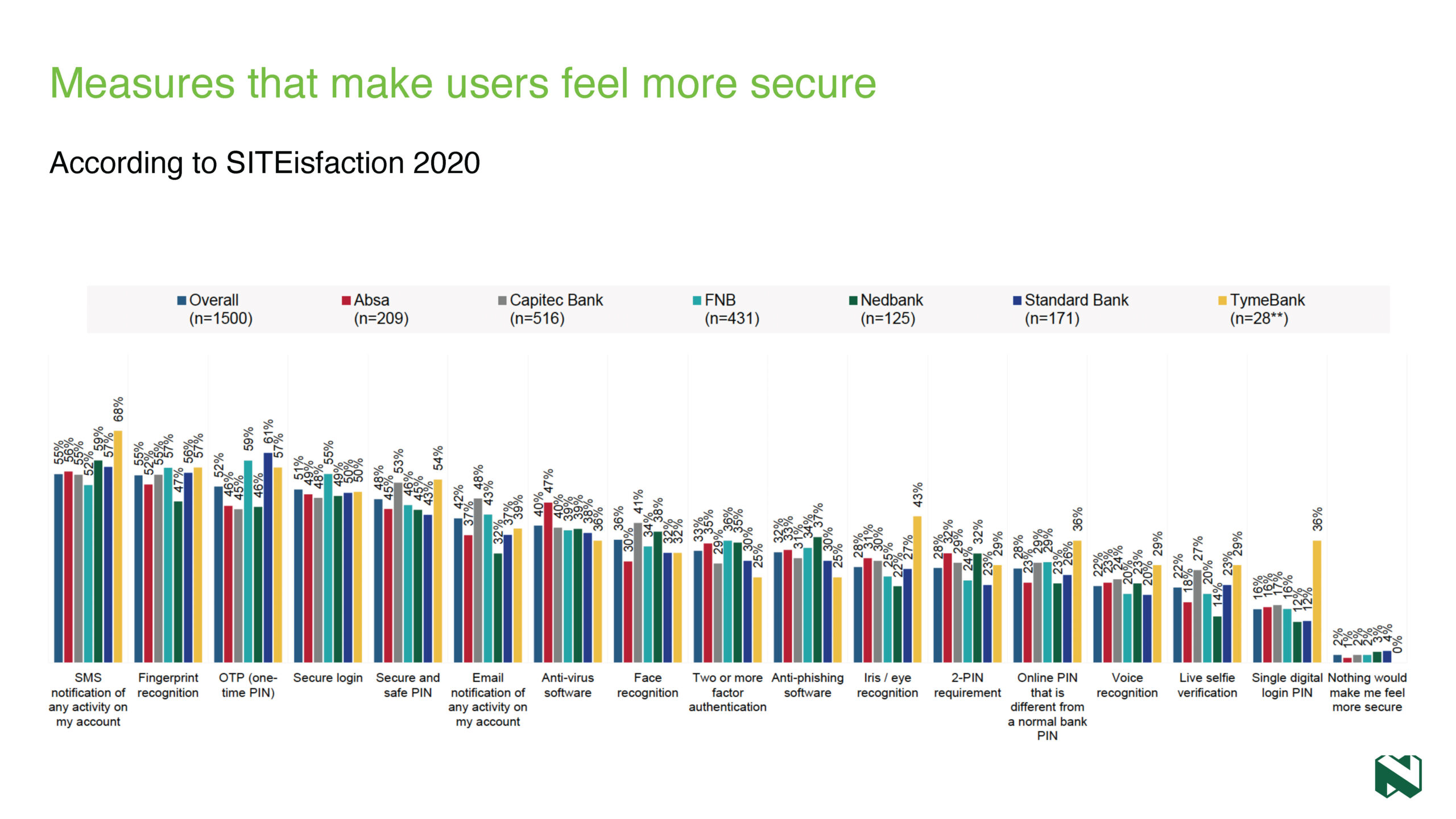

The results of the research were in the form of reports such as competitive analysis, qualitative reports from individuals interviewed and observed, including suggestions for solutions to improve the baking client experience.

The reports and insights would be used by various projects to help inform the designs and ultimate features.

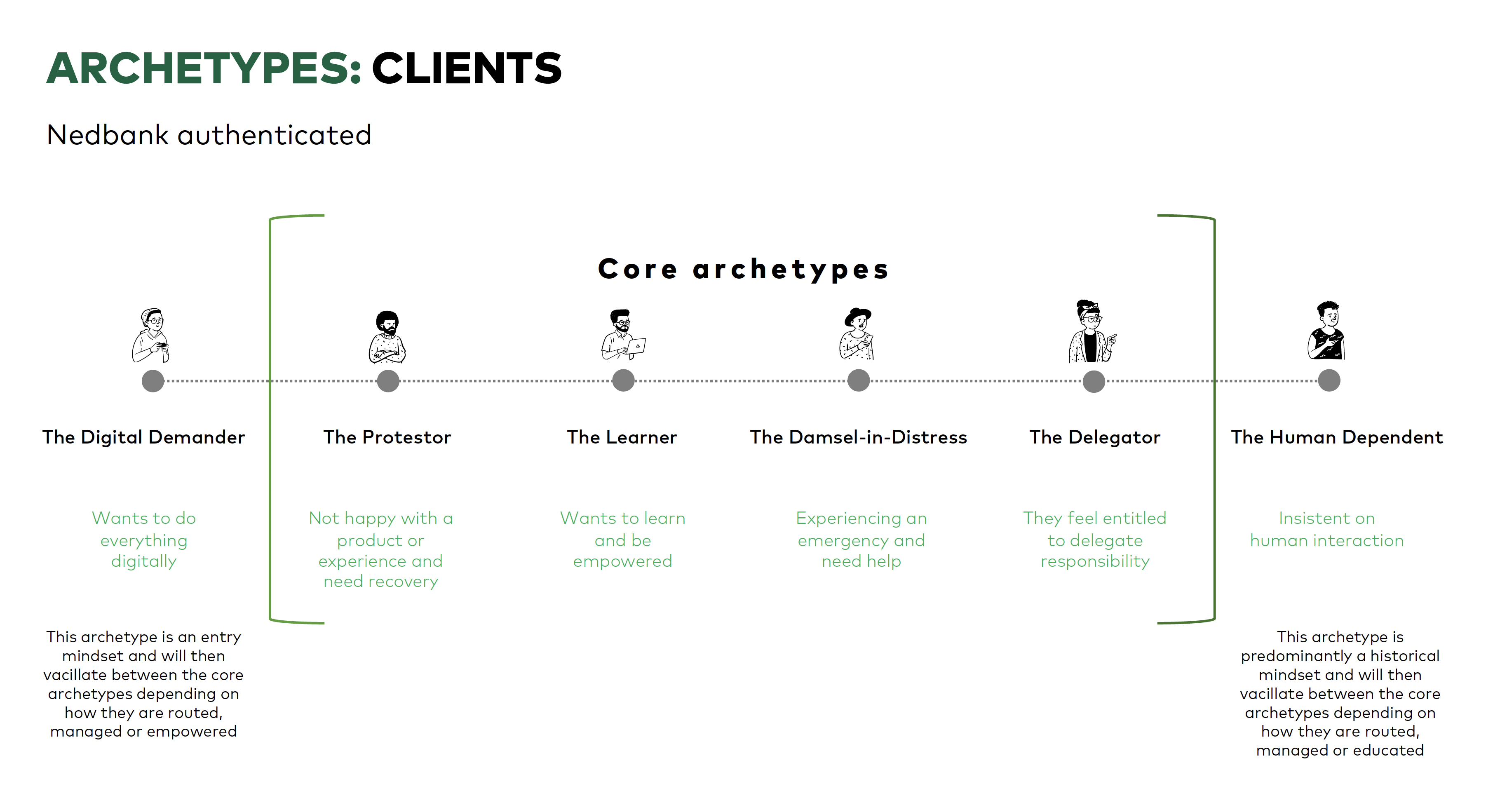

I collaborated with fellow CX specialists in developing an archetype document that would help us keep our customers in mind. Having personas are good for individual situations, but I suggested that by developing archetypes for the millions of customers that the bank deals with on a daily basis, as our customer base was so broad and varied that having individual persona profiles would be impractical.

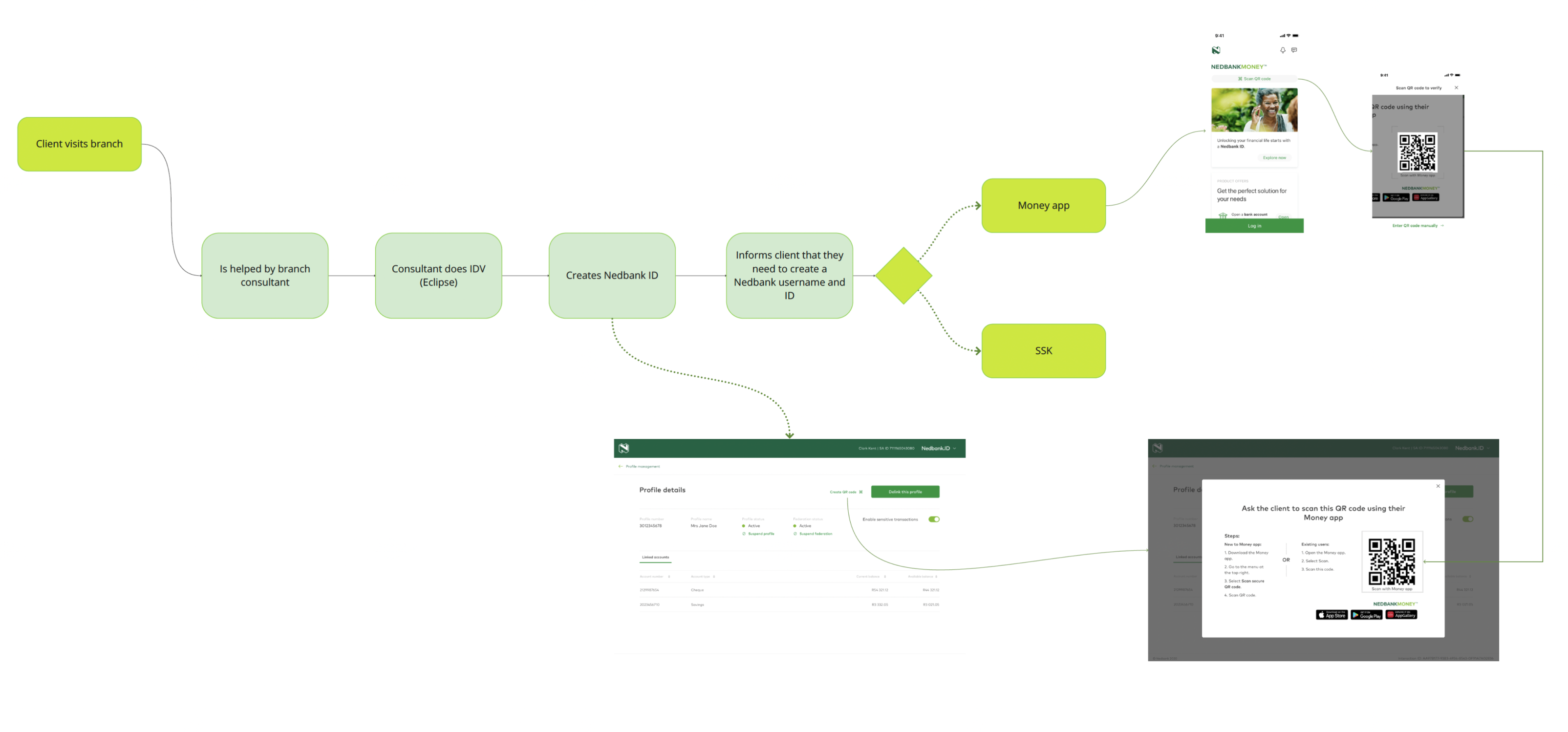

An example of one of the reports provided to the Nedbank ID team: